Demystifying the electronic payment process so that you can accept credit card payments from parents.

It’s time to cut through the confusion surrounding electronic payments so that you can make the right options for your organization more clear. With off-the-shelf options like PayPal and Square, in addition to the myriad other choices flooding the market today it’s easy to get confused. However, with knowledge of just a few basic terms and concepts your choices will become much simpler.

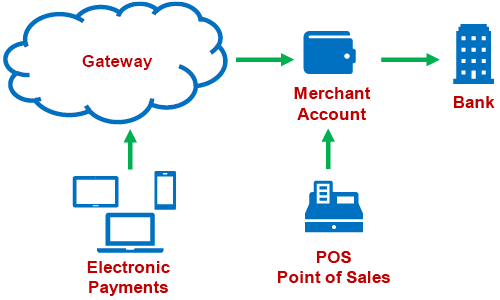

Gateway: Many of you already process credit card payments through a terminal or point of sale system at your child care center. To accomplish this you had to set up a merchant account which processes your credit card transactions, deducts transaction fees and other charges, and then deposits the remaining balance into your bank account. When it comes to processing credit cards and other transactions such as ACH on the web, or through an app, you will need one additional party known as a gateway. Many merchant account providers are affiliated with a gateway, or in some cases are gateways themselves. In either case fees for these services may or may not show up on your bill as many merchant account providers build the fees into their transaction fees and other charges. Gateway fees can range between $15 and $50 a month for access to a gateway if you are processing credit cards online. Remember that having a merchant account does not automatically mean that you have a gateway or can process payments online as these services must be set up explicitly.

Choosing your providers: With that said, we can now dive into deciding which options work best for your organization. There are numerous providers when it comes to online payments for your organization beginning with off-the-shelf providers such as PayPal and Square. While off-the-shelf providers are enormously popular, easy to set up, and offer freebies they also represent the high side of individual transaction rates. Other child care systems also provide these type of services usually by reselling them packaged with their existing products and charges. These services can be a good option for in-home childcare businesses, or child care centers that are just getting started and have a small number of transactions each month. Most banks and credit unions can provide you with individual transaction rates that often significantly reduce costs to your organization overtime. Additionally, substantial savings can be had by going with a value-added-merchant service providers like our partners at First American. These partners offer “rate matching” and a host of other services in addition to the ability to process ACH transactions. This is an important consideration as most off-the-shelf services do not work with ACH, which is increasingly popular among child care customers.

At the end of the day you want to choose a service provider that will be transparent with costs, provide the greatest range of services, and meet the financial needs of both your customers and your organization. A great first step is to check with your current bank or credit union which will provide a good option, or at least a benchmark for vetting other value-added partners like ours. Please let us know if you have any questions about electronic payments for child care centers, or any other child care management tips you would like for us to provide in the future!

Recent Articles from Prime:

5 Ways to Incorporate Technology into Your Daycare’s Emergency Plan

It’s essential to have an emergency plan in place for any variety of emergencies that could crop up during an average day at your childcare center. The use of technology can provide instant communication during moments of crisis and eliminate extra tasks that could take attention away from children when they need it most. … Read More

5 Tips and Tricks for Getting Children On Board With New Hygiene Requirements

Covid-19 has changed the way most businesses practice. If you run a childcare facility, you know this firsthand. As parents begin to head back to work and schools begin to implement reopening plans, you find yourself needing to balance getting things “back to normal” with hygiene and sanitation practices that keep children, parents, and staff members safe. … Read More

Demystifying Electronic Payment

Demystifying the electronic payment process so that you can accept credit card payments from parents. It’s time to cut through the confusion surrounding electronic payments so that you can make the right options for your organization more clear. With off-the-shelf

Meeting Quality Standards With Optimum Classroom Ratios

Parents prize quality when looking for a childcare program. Get the right info about optimum classroom ratios to meet quality standards. … Read More

Protect Student Data With a Software Privacy Audit

New privacy laws are proliferating across the globe. With the increase of cyber breaches, a software privacy audit is a critical first step in protecting student data. … Read More

How to Know If It’s Time to Hire Fewer (or More!) Daycare Teachers

Finding the right balance with staffing numbers is always tricky, even in the best of times. Like most businesses, though, day care centers are making tough financial decisions to keep their doors open. … Read More